Medicare Part C – Medicare Advantage Plans

Medicare Advantage Plans, sometimes called “Medicare Part C Plans” or “MA Plans,” are offered by private companies approved by Medicare. Medicare Advantage Plans for seniors nationwide include Health Maintenance Organizations (HMO), Preferred Provider Organizations (PPO), Private Fee-for-Service Plans (PFFS), Special Needs Plans (SNP), and Medicare Medical Savings Account Plans (MSA). If you’re enrolled in a Medicare Advantage Program, Medicare services are covered through the plan and aren’t paid for under Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage.

Medicare Part C, known for its broad healthcare benefits, encompasses services like dental, vision, and hearing care, along with prescription drug coverage. It connects you with a healthcare provider network for effective health management. Offering more than Original Medicare, Part C includes additional, customizable coverage options, ensuring comprehensive healthcare tailored to your individual needs and financial capacity.

Medicare Part C Coverage Explained

In all types of Medicare Advantage Plans or Medicare Part C Plans, you’re always covered for emergency and urgently needed care. Medicare Advantage Plans must cover all of the services that Original Medicare covers except hospice care. Original Medicare covers hospice care even if you’re in a Medicare Advantage Plan.

Medicare Part C encompasses the coverage of Parts A and B, adding more benefits. It includes hospital and doctor visits, skilled nursing, hospice, and home health care. Additionally, Part C plans often extend coverage to dental, hearing, and vision care, gym memberships, a Medicare Food Allowance, prescription drugs, certain OTC medications, and transportation for medical appointments. The specific benefits differ across plans, so it’s crucial to examine each plan’s details before enrolling.

Medicare Advantage Programs may offer extra coverage, like vision, hearing, dental, and/or health and wellness programs. You usually get prescription drug coverage (Part D) through the plan. In some types of plans that don’t offer drug coverage, you can join a Medicare Prescription Drug Plan.

You can’t have prescription drug coverage through both a Medicare Advantage Plan and a Medicare Part D Prescription Drug Plan. If you’re in a Medicare Advantage Plan that includes drug coverage and you join a Medicare Prescription Drug Plan, you’ll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare.

Medicare Part C: What does it cost?

Medicare Part C costs vary by plan and location. Typically, you pay the standard Part B premium and any extra premium the Part C plan charges. Even with $0 premium plans, there can be other costs. Key expenses to consider in Part C plans include:

- Monthly premiums

- Deductibles

- Copayments/coinsurance

- Out-of-pocket maximums.

For detailed comparisons and understanding the right plan for you, consulting a My Senior Health Plan licensed insurance agent is advisable, as they can guide you through the specifics and help find a plan that matches your needs.

In addition to your Part B premium, you usually pay a monthly premium for the Medicare Advantage Plan. Most people pay the Part B premium of $174.70 each month in 2024.

Which is better: A Medicare Part C HMO or PPO?

Choosing between an HMO or PPO Medicare Part C plan hinges on your healthcare needs and preferences. HMO plans require selecting a primary care physician within their network, and referrals are needed for specialists and certain services. They typically offer lower premiums and costs, but with restricted provider networks and less choice in healthcare providers. PPO plans, conversely, provide greater flexibility in choosing providers, including out-of-network options without referrals. While PPOs usually have higher premiums than HMOs, they offer more freedom and easier access to specialists.

Medicare Part C Eligibility

To qualify for Medicare Part C, you need to fulfill specific criteria: enrollment in both Medicare Parts A and B, residence within the plan’s service area, and typically not having end-stage renal disease (ESRD), although there are exceptions. Keep in mind that while most Medicare recipients can opt for Part C, certain plans might have extra requirements or limitations. Consult a licensed insurance agent at My Senior Health Plan for detailed information on Medicare Part C and to determine if it suits your needs.

Medicare Part C Enrollment

The deadline for enrolling in Medicare Part C varies based on your Medicare status and timing. New to Medicare? Enroll in a Medicare Advantage plan during your Initial Enrollment Period, which starts three months before you turn 65, includes your birth month, and continues for three months after. Existing Medicare beneficiaries can enroll or switch their Medicare Advantage plan during the Annual Enrollment Period from October 15 to December 7. The Medicare Advantage Open Enrollment Period from January 1 to March 31 allows changes or a switch back to Original Medicare. Special Enrollment Periods may apply in specific situations like moving or losing employer coverage, with varying lengths and criteria.

Enrolling in Medicare Part C is straightforward:

- Begin by exploring and comparing available Medicare Part C plans in your area by entering your zip code. You can refine your search based on factors like the insurer, premium, and type of policy.

- When you select a suitable plan, reach out to the insurance provider for enrollment. This can be done either through their website or by phone. Keep your Medicare card and personal details ready for this process.

- After enrolling, you’ll get a new membership card and details about your plan, including benefits and the network of providers.

Once you understand the benefits, costs, and rules associated with your preferred Medicare Advantage Plan you will need to enroll into the plan when you turn 65 or during a Special Enrollment Period. If you are already on a Medicare Advantage Plan you can switch your plan every year during the Annual Enrollment Period which runs from October 15th – December 7th every year. With these steps, you’ll have the assurance of comprehensive healthcare coverage to suit your individual needs.

How to Decide between Medicare Part C vs. Original Medicare

When comparing Medicare Part C with Original Medicare, consider these distinctions:

- Provider Choices: Part C plans typically use specific provider networks, meaning coverage is mainly for in-network doctors and hospitals. Original Medicare offers flexibility to use any Medicare-accepting provider.

- Extra Benefits: Part C often adds benefits like dental, vision, and fitness programs, not included in Original Medicare.

- Spending Cap: Part C has an annual out-of-pocket expense limit, providing financial protection against high costs, unlike Original Medicare.

- Drug Coverage: Part C frequently bundles prescription drug coverage, while with Original Medicare, a separate Part D plan is needed for drugs.

These differences are key to selecting a plan that aligns with your individual healthcare needs.

Comparing Medicare Part C and Medigap

When choosing between Medicare Part C and Medigap, it’s important to understand their differences:

- Network Limits: Part C plans may restrict you to certain providers, while Medigap allows any Medicare-accepting provider.

- Extra Coverage: Part C often covers dental, vision, and more, which Medigap doesn’t offer.

- Out-of-Pocket Expenses: Part C plans come with their cost-sharing methods. Medigap, however, aims to minimize costs not covered by Original Medicare.

- Drug Coverage: Prescription drugs are often included in Part C, but not in Medigap; you’d need a separate Part D plan with Medigap.

Evaluate based on your personal healthcare needs and preferences.

How to Secure Help with Medicare Part C

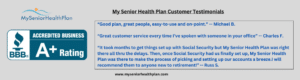

Don’t navigate the complexities of Medicare alone. The senior health licensed agents at My Senior Health Plan are here to help. Call us today at (877) 255-6273 for fast and reliable assistance from knowledgeable Medicare experts. We’re here to ensure that you have the peace of mind that comes with knowing you’re making informed decisions about your healthcare coverage. So, contact us today and let us assist you every step of the way.

Medicare Part C FAQs:

FAQ #1: Is it beneficial to secure Medicare Part C coverage?

A: Whether Medicare Part C (Medicare Advantage) is beneficial depends on individual healthcare needs and preferences. Medicare Part C plans often offer additional benefits not covered by Original Medicare, such as dental, vision, and hearing care. They may also include prescription drug coverage and have an out-of-pocket maximum, providing a cap on annual expenses.

However, these plans typically have network restrictions, meaning you may need to use healthcare providers within the plan’s network. It’s important to compare the costs, coverage options, and provider networks of Medicare Advantage plans against your healthcare needs and budget to determine if Part C is beneficial for you. Always consider consulting with a My Senior Health Plan healthcare advisor to make an informed decision.

FAQ #2: Are all Medicare Part C plans the same?

A: Medicare Part C plans, also known as Medicare Advantage, are not uniform and differ in terms of the benefits they offer, the healthcare provider networks they include, and their cost structures. It’s crucial to assess and compare the various Part C plans available in your region to select one that aligns well with your healthcare requirements and financial situation.

FAQ #3: Am I free to see any doctor with my Medicare Part C plan?

A: In Medicare Part C plans, your access to healthcare is often limited to a specific network of doctors and hospitals. However, some of these plans do offer the flexibility to seek care outside the network, though this might incur higher expenses. It’s important to carefully understand the network limitations of a Part C plan before you decide to enroll in one.

FAQ#4: Does Medicare Part C cover prescription drug costs?

A: Many Medicare Part C plans (also known as Medicare Advantage plans), typically encompass prescription drug coverage and are termed Medicare Advantage Prescription Drug plans (MA-PDs). By enrolling in an MA-PD, you receive a comprehensive package that includes both medical and prescription drug coverage. However, it’s important to note that not every Medicare Part C plan includes prescription drug coverage, so you should carefully check each plan’s specifics to ensure it aligns with your healthcare and medication needs..

FAQ #5: What is a “Flex Card” and can I get one with a Medicare Advantage Plan?

A: A Medicare Flex Card is a type of benefit card offered by some Medicare Advantage plans. It is essentially a pre-loaded debit card that beneficiaries can use to pay for certain healthcare-related expenses. These expenses typically include co-pays, deductibles, and sometimes even over-the-counter medications or healthcare items not covered by traditional Medicare. The amount of money available and the specific eligible expenses depend on the individual Medicare Advantage plan. It’s important to note that not all Medicare Advantage plans offer this type of card, and the benefits can vary between plans.

FAQ #6: If I enroll in a Medicare Advantage Plan, can I switch to Original Medicare?

A: You have the opportunity to switch from a Medicare Part C plan back to Original Medicare during two specific periods. The first is the annual enrollment period, which is from October 15 to December 7 each year. Additionally, there is a Medicare Advantage open enrollment period from January 1 to March 31 each year, during which you can make this switch.

FAQ #7: If I move, what happens to my Medicare Part C plan?

A: When you relocate outside of your current plan’s coverage area, you have the option to either return to Original Medicare or join a different Medicare Part C plan. Generally, you’re granted a Special Enrollment Period (SEP) to choose a new Medicare Part C plan outside the usual annual enrollment period (AEP). This SEP typically starts in the month prior to your move and extends for two additional months after relocating.

FAQ #8: How and where do I file a claim with Medicare Part C?

A: Typically, your Medicare Part C plan provider handles claim submissions. If you need to submit a claim, contact your plan provider for their specific procedures and any required forms. Fill out these forms accurately and include an itemized bill copy. It’s advisable to keep duplicates of all documents you submit for your personal records.