Medicare Part A and Part B

Navigating Medicare as you near retirement can be a complex process. This federal health insurance program caters to those 65 or older, certain disabled individuals, and people with End-Stage Renal Disease, encompassing Parts A, B, C, and D. Medicare Part A, or hospital insurance, covers inpatient hospital stays, skilled nursing care, hospice, and home health services. You might not need to pay a monthly premium for Part A if you’ve contributed Medicare taxes during your employment. However, be mindful of other costs like deductibles and copayments. Understanding Part A is key to effectively planning your healthcare in retirement.

Medicare Part A: What does it cover?

- Inpatient Hospital Care: Medicare Part A encompasses various hospital inpatient services like shared rooms, meals, standard nursing, and essential medications, including those for opioid use disorder. Eligibility requires a doctor’s order for inpatient care and a Medicare-participating hospital. However, Medicare Part A doesn’t cover private nursing, private rooms (unless needed for medical reasons), or personal items such as grooming products. Also, separate charges like room telephones or TVs aren’t included in the coverage.

- Skilled Nursing Facility Care: Medicare Part A provides short-term skilled nursing care under specific conditions. Eligibility includes remaining benefit days, a qualifying hospital stay, a physician’s assessment for daily skilled care, and care in a Medicare-certified facility. It’s essential for the skilled services to relate to a condition treated during a recent hospital stay or one that emerged in the nursing facility. Coverage includes shared rooms, meals, various therapies, medical social services, necessary medications, equipment, emergency transport to treatment facilities, and diet counseling.

- Home Health Care: For homebound individuals, Medicare Part A and/or Part B may cover home health services. Eligibility requires a doctor’s certification and the use of a Medicare-certified agency. Services include part-time skilled nursing, home health aide care, various therapies, medical social services, certain drugs, and home-use medical supplies. It’s crucial to note that Medicare doesn’t cover 24-hour home care, meal delivery, or non-medical homemaker services. Also, personal custodial care isn’t included. Understanding your coverage and collaborating with a Medicare-certified agency ensures you receive the right home health services.

- Hospice Care: For those with terminal illnesses, hospice care, emphasizing comfort and life quality, is a viable option under Medicare Part A. To qualify, both your hospice and regular doctors must confirm a life expectancy of six months or less, and you must opt for palliative over curative care. Hospice services, available at home or specialized facilities, include medication, symptom relief, and caregiver support, but note that room and board costs aren’t covered by Medicare.

Medicare Part A: What does it cost?

Most individuals are exempt from the Part A premium due to a decade of Medicare tax contributions while working. If not exempt, you might pay $278 or $506 monthly, based on your work history. Purchasing Part A also requires enrolling in Part B, which covers various medical services and supplies. Not enrolling in Part A during your initial Medicare eligibility can lead to penalties. Understanding Medicare’s enrollment process is crucial.

Once enrolled in Part A, a $1,600 deductible applies per hospital or skilled nursing facility admission before Medicare payments begin. Benefit periods end after 60 days without inpatient care. Multiple benefit periods annually can lead to multiple deductible payments. Hospital stays under 60 days incur no charges post-deductible; however, longer stays involve daily copayments, escalating after 90 days. For skilled nursing facility care, there’s no charge for the first 20 days, followed by daily copayments up to 100 days, of which all costs are your responsibility. Home health care has no service charges but requires 20% payment for durable medical equipment. Hospice care generally incurs no charges, though some costs like prescription copayments or respite care may apply.

Medicare Part A: When am I eligible?

To qualify for Medicare Part A, you typically need 10 years (or 40 quarters) of Social Security contributions through work. However, you might still be eligible through a spouse or ex-spouse’s work history, or if you have a qualifying disability. Eligibility also requires being 65 or older, receiving disability benefits for at least two years due to a permanent disability, or having Amyotrophic Lateral Sclerosis (ALS) or End-Stage Renal Disease (ESRD). You’re automatically enrolled in Part A if you meet these conditions; otherwise, you must apply for it.

Medicare Part A: What is the enrollment deadline?

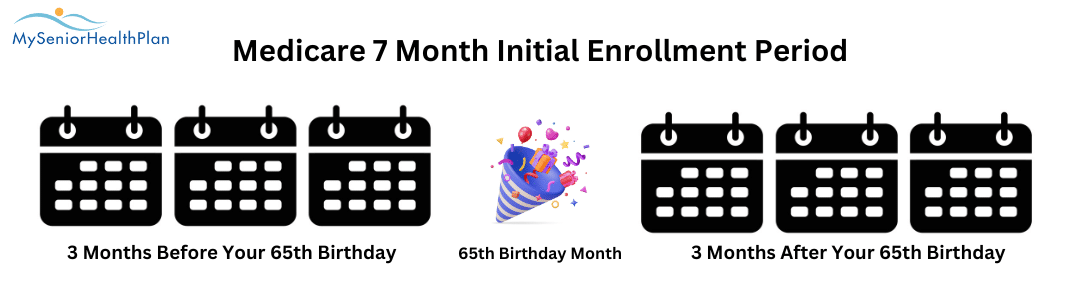

Upon turning 65, if you’re already receiving Social Security or Railroad Retirement Board benefits, you’ll be auto-enrolled in Medicare Part A and Part B. If not, you must sign up during your Initial Enrollment Period (IEP) or another enrollment time to prevent penalties and coverage gaps.

- Your IEP starts three months before and extends three months after your 65th birthday month, allowing enrollment in Medicare Part A, B, C (Medicare Advantage), and Medicare Part D (prescription drugs).

- Missing the IEP means you can enroll during the General Enrollment Period (January 1-March 31), but coverage begins July 1, possibly incurring late penalties.

- Special Enrollment Periods (SEPs) cater to specific events like relocation or insurance loss, offering a 2-month penalty-free enrollment window.

Understanding your eligibility and enrollment periods is vital for seamless healthcare coverage post-65.

Medicare Part A: How do I enroll?

Enrolling in Medicare is possible via the Social Security website. Start by setting up a Social Security account and proceed with the Medicare enrollment steps. If you prefer, call the Social Security Administration at 1-800-772-1213 for guidance. Whichever method you choose, they offer support and answers to any enrollment-related queries you might have.

Medicare Part A: How do I get help?

Let the Medicare senior health care professionals at My Senior Health Plan guide you through Medicare’s complexities. Our licensed agents are ready to provide expert support. For prompt, knowledgeable assistance, call (877) 255-6273. We’re dedicated to giving you the confidence of well-informed healthcare decisions. Reach out to us for comprehensive guidance at every step.

Need advice and counsel on which Medicare plan(s) are the best for your unique, individual needs? Contact a Medicare senior health specialist at My Senior Health Plan today!

Medicare Part B: What is it?

Medicare Part B, available to U.S. citizens over 65 or those with certain disabilities or conditions, is a component of Medicare that covers necessary medical services and supplies. This includes:

- Doctor appointments

- Outpatient treatment

- Preventative care

- Some medical equipment

Enrollment in Part B is optional but requires a monthly premium. Part B typically covers 80% of medical service costs, leaving the remaining 20% as the beneficiary’s responsibility, along with any applicable deductibles and copayments. Note that Part B doesn’t cover dental, vision, hearing, or long-term care. Understanding Part B’s specifics aids in making informed healthcare decisions.

Medicare Part B: What does it cover?

Medicare Part B (Medical Insurance) encompasses two primary areas:

- Doctor Visits: Coverage includes visits to various healthcare professionals, from primary care doctors to specialists. It’s wise to confirm with both your provider and Medicare about coverage before any visit to ensure affordability and necessary care.

- Outpatient Care: Part B covers a broad spectrum of outpatient services, which are treatments or procedures not requiring an overnight hospital stay. This includes outpatient surgeries, diagnostic tests, mental health services, therapies, and rehabilitation services. However, the coverage scope for each service can vary, so verifying with healthcare providers and Medicare is advisable for specific service coverage.

- Home Health Care: Medicare Part B includes home health care, offering services by skilled professionals like nurses and therapists in your home. It encompasses various care options such as nursing, therapies, and medical social services. To be eligible, you need to be homebound requiring professional care, under a doctor’s prescribed care plan. This plan might cover services ranging from wound care to rehabilitation.

- Preventative Care: Medicare Part B covers a broad spectrum of preventive care services, essential for maintaining health and managing chronic illnesses. This includes services like annual wellness checks, various screenings (cancer, diabetes, heart disease), and flu vaccinations. If your healthcare provider accepts Medicare, most of these services won’t cost you anything. Part B also includes vaccines such as flu and pneumococcal shots, though sometimes a copayment or coinsurance is required. Always verify with your provider and Medicare to confirm coverage for specific preventive services or vaccines. This helps in managing your health and warding off serious conditions.

- Durable Medical Equipment (DME): Medicare Part B encompasses coverage for durable medical equipment (DME), which includes reusable medical items like wheelchairs, walkers, hospital beds, and certain prosthetics for home use. This equipment must be medically necessary, doctor-prescribed, suitable for home use, and cost-effective. Part B also extends to essential supplies needed for these devices, like batteries or tubes. It’s important to understand the specifics of DME coverage under Part B to ensure you get the necessary equipment for your medical needs. Always verify specific equipment coverage with your healthcare provider and Medicare.

Medicare Part B: What does it cost?

For Medicare Part B in 2024, understand these key costs: the monthly premium is $174.70, higher for higher incomes, and is mandatory even if you don’t use Part B services. It’s also worth noting that delaying Part B enrollment may lead to a rising penalty. After paying a $240 deductible, you’re responsible for 20% of Medicare-covered services if the provider accepts Medicare rates. Lab services and home health care are fully covered, but 20% is owed for durable medical equipment. Inpatient hospital care incurs 20% of the doctor’s fees. Outpatient mental health care also requires a 20% payment, except for a free annual depression screening, with possible extra charges at hospital outpatient clinics. Partial hospitalization mental health care costs include the deductible and 20% of the service fee, plus daily coinsurance at outpatient facilities. Outpatient hospital care also involves paying 20% for provider services and a copayment, capped at the Part A hospital stay deductible.

Medicare Part B: When am I eligible?

To qualify for Medicare Part B, you need to be a U.S. citizen or a legal permanent resident with at least five years of residency. Eligibility begins at age 65, but automatic enrollment occurs if you’re receiving Social Security or Railroad Retirement Board benefits. People under 65 with disabilities, like those receiving Social Security Disability Insurance for 24 months or diagnosed with ALS (Lou Gehrig’s disease), can also enroll in Medicare Part B.

Medicare Part B: What is the enrollment deadline?

Comprehending Medicare Part B enrollment deadlines is key to avoiding penalties and the deadline varies based on your individual circumstances. If you’re nearly 65 and not on Social Security, enroll during the seven-month period around your birthday to dodge late penalties. Automatic enrollment at 65 occurs for those on Social Security. If covered by an employer’s plan, enroll during the special period post-employment or coverage loss. For those with qualifying disabilities, enrollment happens after 24 months of SSDI benefits, or immediately with ALS. Missing initial or special periods may lead to increased monthly premiums due to late penalties.

Medicare Part B: How do I enroll?

Enrolling in Medicare Part B can be done online via the Social Security website. As an alternative, you have the option to send your completed and signed Medicare Part B enrollment application to your local Social Security office via mail or fax. For further assistance or information, contacting Social Security at 1-800-772-1213 is recommended.

Medicare Part B: How do I get help?

Navigate Medicare’s complexities with the assistance of My Senior Health Plan’s experienced healthcare experts. Our licensed professionals are on hand to offer specialized support. For immediate and informed help, dial (877) 255-6273. We’re committed to empowering you with the knowledge to make sound healthcare choices. Contact us for all-encompassing guidance throughout your Medicare journey.

If you’re seeking personalized recommendations on the most suitable Medicare plans for your specific needs, don’t hesitate to reach out to a senior health specialist at My Senior Health Plan.

Lower Healthcare Costs with a Medigap Policy

Medigap, or Medicare Supplement Insurance, fills in cost gaps that original Medicare doesn’t cover, like deductibles and copayments, offering a financial safety net. Medicare, while extensive, leaves some out-of-pocket expenses. For instance, Medicare Part A has a $1,632 deductible per benefit period in 2024, and Part B has a $240 annual deductible.

Medigap policies alleviate these extra costs, providing coverage for Part A and B deductibles, coinsurance, and copayments. They offer different coverage levels, letting beneficiaries choose plans based on their healthcare needs and budget. At My Senior Health Plan, our licensed agents can guide you in selecting the right Medigap plan to manage healthcare costs effectively.

Medicare Part A and Part B FAQs:

FAQ #1: Are Medicare Part A and Part B free?

A: Medicare Part A, known as Hospital Insurance, is free for individuals who, or whose spouse, have contributed to Medicare taxes for at least 10 years during employment. For those who receive Medicare before turning 65, Part A comes without a premium. While Medicare Part A covers a wide range of healthcare services, it’s essential to be aware that there are deductibles, copayments, and coinsurance costs to be paid by you. Despite these out-of-pocket expenses, Part A can significantly alleviate the financial burden of healthcare and offer considerable reassurance regarding your health expenses.

Medicare Part B typically requires a monthly premium. The standard premium amount can change each year and may be higher based on your income. Part B covers medical services and supplies, including doctor visits and outpatient care. Individuals who receive Medicare are usually responsible for the Part B premium, even if they don’t use the services.

FAQ #2: Which Medicare Plan do I choose – Part A or Part B?

A: Medicare Part A and Part B are not meant to compete against each other, but rather serve as complementary elements of your healthcare coverage. Part A mainly deals with hospital and hospice care, skilled nursing facility care, and some home health services. Part B covers visits to doctors, outpatient care, preventive services, and medical equipment. Together, they offer a comprehensive healthcare plan, and it’s generally advisable to enroll in both for complete coverage tailored to your healthcare needs.

FAQ #3: Is it possible to have Medicare Part A only and not enroll in Part B?

A: If you qualify for premium-free Medicare Part A, you can choose whether to enroll in Part B. This decision should be based on your healthcare needs and financial situation. Enrolling in Part A alone means you would need to cover the costs for services that Part B provides, like doctor visits and outpatient care, out of your own pocket.

FAQ #4: Am I automatically enrolled in Medicare Part A?

A: When you receive Social Security benefits, you’re automatically enrolled in Medicare Part A. If you’re not getting these benefits, you must manually enroll in Part A during your Initial Enrollment Period. This period generally spans seven months, starting three months before your 65th birthday.

FAQ #5: Am I free to enroll in Medicare Part A at any time?

A: Enrolling in Medicare Part A isn’t open at any time. Your eligibility to enroll starts with the Initial Enrollment Period, which is seven months long, beginning three months before you turn 65. If you miss this period, you have the opportunity to enroll during the General Enrollment Period, annually from January 1st to March 31st. Additionally, under certain circumstances like losing employer health coverage or relocating, you may qualify for a Special Enrollment Period to enroll in Part A.

FAQ #6: Is it possible to not qualify for Medicare Part A?

A: Eligibility for Medicare Part A has specific requirements. Individuals under 65 without a qualifying disability, or who haven’t contributed to Medicare taxes for at least 10 years (or 40 quarters), typically don’t qualify for Part A. Also, if you cannot qualify through the work history of a current, former, or deceased spouse, you might be ineligible for Medicare Part A.

FAQ #7: Is Full Coverage Provided by Medicare Part A Post-Deductible?

A: Medicare Part A doesn’t cover 100% of healthcare expenses even after the deductible is met. Inpatient hospital stays incur copayments based on duration. Post-deductible, the first 60 days are free of copayment. Days 61-90 have a daily copayment of $400, and days 91-150, using your 60 lifetime reserve days, attract an $800 daily charge. Costs beyond day 150 are entirely the patient’s responsibility.

FAQ #8: Is it possible to decline Medicare Part A coverage and if so, how do I do that?

A: To opt out of premium-free Medicare Part A, you need to fill out and submit a voluntary refusal form for Medicare Part A and B. This form is obtainable from the Social Security Administration’s website or local offices. Be aware that refusing Medicare Part A might mean losing current or future Social Security or Railroad Retirement Board benefits. Additionally, re-enrolling in Part A later could lead to late enrollment penalties.

FAQ #9: How do I file a claim for Medicare Part A and Part B?

A: To file a Medicare Part A claim, the process is typically handled by your healthcare provider or the facility where you received services. They usually submit the claim on your behalf. However, if you use a provider that does not participate in Medicare, you’ll need to file the claim yourself. This is done by filling out a Patient Request for Medical Payment form and sending it to your Medicare Administrative Contractor (MAC).

Typically, healthcare providers or hospitals file Medicare claims for you. If your provider doesn’t participate in Medicare, you’ll have to file the claim. This involves filling out the Patient Request for Medical Payment form or “CMS-1490S.” You can obtain this form by calling 1-800-MEDICARE or downloading it from the Medicare website.

FAQ #10: What are the Reasons for Only Enrolling in Medicare Part B?

A: Individuals might choose Medicare Part B exclusively for various reasons. These can include postponing their enrollment in Medicare Part A, possessing alternative health insurance that already covers hospital services, being under 65 with a qualifying disability or end-stage renal disease, or opting out of Medicare Part A to remain eligible for a Health Savings Account (HSA).