Medicare Enrollment Periods

Multiple enrollment periods exist for Medicare, each with their own specific functions and set of rules. In certain cases, enrolling in Medicare might not require active effort on your part; you could be automatically registered if you fulfill specific Medicare eligibility conditions. It’s crucial, therefore, to understand the distinct characteristics and schedules of each Medicare enrollment period to ensure timely registration and to steer clear of potential late enrollment fees.

This reference aims to walk you through the various Medicare enrollment periods, outlining their timing and how you can optimize your coverage benefits. Whether you are approaching Medicare for the first time or looking to modify your existing coverage, continue reading to master the intricacies of Medicare enrollment periods!

Medicare Enrollment Period Important Dates

Now is a great time to pull out your calendar and mark some dates! Here are the key dates to remember for Medicare Enrollment Periods:

- Medicare Initial Enrollment Period: Begins 3 months before your 65th birthday and ends 3 months after you turn 65.

- Medicare Annual Enrollment Period: October 15 – December 7.

- Medicare General Enrollment Period: January 1 – March 31.

- Medicare Special Enrollment Period: Usually within 60 days of a life-changing event.

- Medigap Open Enrollment Period: Starts with Medicare Part B enrollment at 65 or older and lasts 6 months.

- Medicare Advantage Open Enrollment Period: January 1 – March 31.

Medicare Initial Enrollment Period (IEP)

The first window for enrolling in Medicare is your Initial Enrollment Period (IEP), beginning three months before and extending three months after your 65th birthday, for a total of seven months. Registering during this period is key to dodging late fees and securing necessary coverage. This Medicare enrollment period allows you to select either Original Medicare (Parts A and B) or a Medicare Advantage Plan (Part C). If choosing Original Medicare, you also have the option to enroll in a separate Prescription Drug Plan (Part D) and consider a Medigap policy for additional coverage of out-of-pocket expenses.

Medicare Annual Enrollment Period (AEP)

Every year from October 15 to December 7, the Medicare Annual Enrollment Period (AEP), presents a chance to reassess and modify your Medicare plans. Actions you can take during the AEP/OEP include:

- Switching between Original Medicare and Medicare Advantage.

- Changing your Medicare Advantage or Prescription Drug Plan.

Any changes made take effect on January 1 of the following year. It’s important to review changes to your current plan in the Annual Notice of Change (ANOC) and adjust your plan during the AEP if needed.

Medicare General Enrollment Period (GEP)

If you miss the IEP and don’t meet criteria for a Special Enrollment Period (SEP), you can sign up for Medicare Parts A and B during the General Enrollment Period (GEP) from January 1 to March 31. Be aware that late enrollment could result in added penalties to your premiums for as long as you have Medicare.

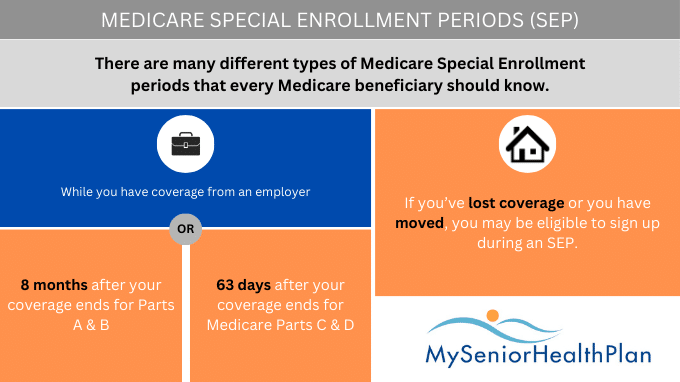

Medicare Special Enrollment Period (SEP)

The Medicare Special Enrollment Period (SEP) is available for certain life changes and allows adjustments to your Medicare plan outside the usual enrollment windows. Some SEP triggers include:

- Job loss

- End of employer coverage

- Eligibility for Medicaid

- Relocating

- Or, certain health conditions.

The duration of a SEP varies, so it’s crucial to contact Medicare promptly after the qualifying event.

Medigap Open Enrollment Period

For extra coverage with Original Medicare, a Medigap policy can be obtained during your six-month Medigap Open Enrollment Period, starting when you turn 65 and are enrolled in Medicare Part B. During this time, insurers cannot refuse coverage or charge higher rates due to pre-existing conditions. Missing this window could lead to higher premiums or coverage denial.

Medicare Advantage Open Enrollment Period

From January 1 to March 31, the Medicare Advantage Open Enrollment Period (OEP) lets you make a single change to your Medicare Advantage plan, switch back to Original Medicare, or opt for a different Medicare Advantage plan. If returning to Original Medicare, you can also join a stand-alone Prescription Drug Plan during this time. However, switching to Medicare Advantage from Original Medicare is not permitted during the OEP.

Expert Assistance with Medicare Enrollment

In need of professional assistance for Medicare enrollment? The experienced and licensed agents at My Senior Health Plan are here to help. Contact us at (877) 255-6273 for tailored, expert advice throughout your Medicare enrollment process. Our dedicated team is focused on helping you comprehend all your choices, guiding you seamlessly through the enrollment steps, and ensuring your timely registration to prevent any late fees. Rely on My Senior Health Plan for aid in making knowledgeable decisions about your Medicare coverage.

Medicare Enrollment FAQs

FAQ #1: How much do I have to pay for Medicare when I turn 65?

A: Should you not qualify for Part A without a premium, the monthly expense could reach as high as $506. Neglecting to sign up for Part A upon first becoming eligible for Medicare, usually around age 65, could lead to incurring a penalty. For most individuals, the standard monthly fee for Part B stands at $174.70 as of 2024.

FAQ #2: Am I eligible to change my Medicare plan post-enrollment?

A: Absolutely, it’s possible to modify your Medicare plan post-enrollment. The Annual Enrollment Period (AEP), running annually from October 15th to December 7th, is typically when most changes are made. In this timeframe, you have the option to transition from Original Medicare to a Medicare Advantage plan, choose a different Medicare Advantage plan, or alter your prescription drug plan. Additionally, there’s a Medicare Advantage Open Enrollment Period between January 1st and March 31st, where specific changes can be made.

FAQ #3: What are the consequences if you don’t enroll in Medicare on-time?

A: Should you miss the deadline for Medicare enrollment, you could be subject to late enrollment fees. In the case of Medicare Part B (medical insurance), failing to enroll during your Initial Enrollment Period (IEP) and lacking any other qualifying coverage could lead to a rise in your monthly premium. This increase is calculated as a percentage for every year you were eligible but did not sign up. Regarding Medicare Part D (prescription drug coverage), you might incur a late enrollment penalty if there’s a gap of 63 continuous days or more without creditable prescription drug coverage following your Initial Enrollment Period.

FAQ #4: What is Medicare credible coverage?

A: Medicare creditable coverage is defined as health insurance that offers benefits at least equivalent to those provided by Medicare. This includes prescription drug plans that, on average, are expected to cover as much as or more than the standard prescription drug coverage under Medicare.

FAQ #5: What is the IEP for Medicare coverage before you turn 65?

A: The Medicare Initial Enrollment Period (IEP) prior to reaching the age of 65 spans seven months. It starts three months before your 65th birthday month and continues for three months following that month. During this period, you have the opportunity to enroll in Medicare for the first time and select your coverage plans.

FAQ #6: What happens when you don’t enroll in Medicare Part A when you turn 65?

A: Failing to sign up for Medicare Part A (hospital insurance) at age 65, when not qualified for premium-free Part A through your or your spouse’s employment record, can result in a late enrollment penalty. This penalty is applied to your Part A premium. The specific penalty amount is determined by the length of time you waited to enroll in Part A after initially becoming eligible.

FAQ #7: When is the open enrollment period for Medicare Advantage Plans?

A: Medicare Advantage Plans have an Open Enrollment Period known as the Annual Enrollment Period (AEP). Typically, this period extends from October 15th to December 7th each year. Throughout these dates, you have the option to enroll in, change, or opt out of Medicare Advantage Plans.

FAQ #8: Is there an open enrollment period for Medicare Supplement Plans?

A: Indeed, there is an Open Enrollment Period specifically for Medicare Supplement Plans, commonly referred to as Medigap plans. This period spans six months, starting from the first day of the month when you turn 65 or older and are also enrolled in Medicare Part B. In this timeframe, you are granted guaranteed issue rights. This ensures that insurance providers can’t refuse to cover you or impose higher premiums due to your health status.

FAQ #9: When can I get Medicare Advantage or Medicare Part D if I miss my IEP?

A: Should you not enroll in Medicare Advantage or Medicare Part D during your Initial Enrollment Period (IEP), you’ll get a second chance during the Annual Enrollment Period (AEP). Running annually from October 15th to December 7th, the AEP allows you to sign up for, or change, Medicare Advantage plans, as well as Medicare Part D prescription drug plans.