Medicare Part D Plans

Medicare Part D Coverage Explained

Medicare Part D plays a pivotal role in comprehensive healthcare plans by covering prescription drugs, which is crucial given the escalating cost of medications. It’s important to remember that Part D isn’t automatically included in Original Medicare and must be enrolled in separately through a private insurer. With over 700 Medicare Part D plans available in 2024, each offering different drug coverage and costs, it’s critical to evaluate your options. For the most suitable Part D plan, consider consulting a My Senior Health Plan senior health consultant who can help you navigate and compare the plans.

Medicare Part D: What does it cover?

Enrolling in Medicare Part D means choosing a private plan aligned with Medicare each with a unique list of drugs it covers, known as a formulary. These plans often categorize drugs into different “tiers” on their formularies, each with its own cost.

Usually, a drug in a lower tier will be less expensive compared to a drug in a higher tier. Sometimes, if your prescriber believes that you need a drug from a higher tier instead of a similar one from a lower tier, you or your prescriber can request an exception from your plan. This exception could help you obtain the drug with a lower copayment.

These plans cover both brand name and generic drugs, but it’s key to understand that these formularies can change annually. Essential medications such as:

- Antidepressants

- Anticonvulsants

- Cancer drugs

- Antipsychotics

- HIV/AIDS drugs

- Immunosuppressants

are generally covered. However, Part D excludes certain drugs such as:

- Over-the-counter meds

- Weight loss treatments

- Fertility drugs

- Cosmetic prescriptions

- Some vitamins.

Not all life-enhancing drugs are covered either. If necessary, your doctor might request an exception for a non-formulary drug.

Medicare Prescription Drug Plans: What do they cost?

The cost of Medicare Part D depends on the plan, medications used, and coverage gap entry. Key costs include:

- Monthly Premiums: Vary by plan; higher-income individuals may pay extra (IRMAA). Lower income individuals can also pay less or $0.

- Annual Deductible: This upfront cost differs per plan, maxing at $545 in 2024.

- Initial Coverage: Initial Coverage begins after your deductible is met and ends once Rx retail costs reach $5030.

- Coverage Gap (“Donut Hole”): In this phase, you pay 25% for drugs until out-of-pocket costs hit $5,030. When the retail cost of an Rx (retail only) reaches $5,030, you go into the Donut hole and pay 25% of Rx costs (however, this isn’t always the case with all PDPs or all Rx).

- Catastrophic Coverage: Post-gap, you’ll pay minimal amounts for drugs for the year’s remainder. When the retail cost + copays reaches $8,000, you enter Catastrophic. In 2024 Rx copays in Catastrophic Coverage is $0.

Strategies to minimize costs include using generics, exploring therapeutic alternatives, and utilizing preferred pharmacies or mail orders. Always review plan details and consult a licensed insurance agent for guidance.

Medicare Part D: How do I determine if I’m eligible to enroll?

Medicare Part D, focused on prescription drug coverage, has specific eligibility criteria:

- Enrollment in Medicare Part A is required.

- Applicants must be either U.S. citizens or permanent legal residents.

- Age criteria include being 65 or older, or having a qualifying disability.

- Residing within the service region of a Medicare Part D plan is essential.

For any queries about eligibility, consulting with a My Senior Health Plan senior health advisor is advisable for accurate information and guidance. Before you enroll in a Medicare Part D plan consider the following:

1. These plans, also called “PDPs,” provide additional coverage for medications alongside Original Medicare, certain Medicare Cost Plans, select Medicare Private Fee-for-Service (PFFS) Plans, and Medicare Medical Savings Account (MSA) Plans.

2. You have the option to enroll in a Medicare Advantage Plan (Part C), which can be similar to an HMO or PPO, or choose another Medicare health plan that includes prescription drug coverage. These plans provide you with all the benefits of Medicare Part A (Hospital Insurance), Medicare Part B (Medical Insurance), and prescription drug coverage (Part D). Medicare Advantage Plans that offer prescription drug insurance coverage are sometimes referred to as “MAPDs.” To join a Medicare Advantage Plan, it’s necessary to have both Part A and Part B coverage.

Medicare Part D: When is the enrollment deadline?

As a Medicare recipient, it’s vital to be aware of the key dates for Medicare Part D enrollment to avoid missing out on prescription drug coverage or incurring penalties:

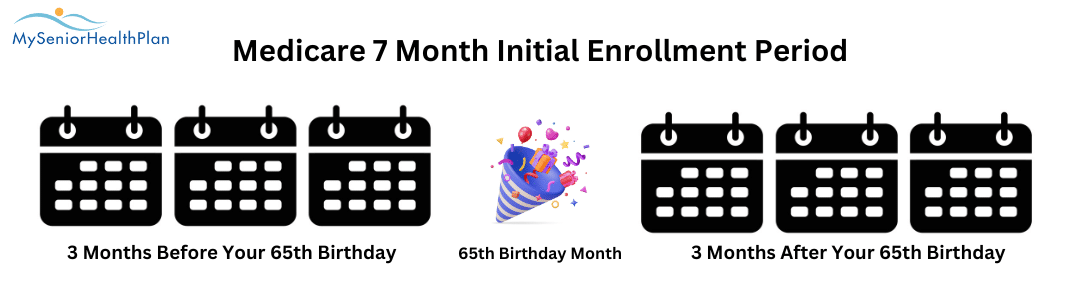

- Initial Enrollment Period (IEP): This seven-month window surrounds your 65th birthday, starting three months before and ending three months after. For those qualifying due to disability, the IEP is centered around the 25th month of disability benefit receipt.

- Annual Enrollment Period (AEP): Running from October 15th to December 7th annually, this period allows you to enroll, switch, or drop a Medicare Part D plan, with changes effective from January 1st of the following year.

- Special Enrollment Period (SEP): Triggered by specific life events like losing employer-based coverage or relocating, SEPs enable plan adjustments outside regular enrollment times.

Not enrolling in Medicare Part D during the IEP can lead to a late enrollment penalty, which is a monthly premium increase. To avoid this, sign up during your IEP or maintain creditable coverage. Each fall, review your plan’s documents for any changes in the upcoming year and assess if your current plan remains suitable.

How do I sign up for Medicare Prescription Drug coverage?

Enrolling in Medicare Part D, the prescription drug coverage plan, is relatively straightforward:

- Explore Plans: Input your zip code on the My Senior Health Plan website to see the Medicare Part D plans available in your area. Filter your search by different factors like company, premiums, and plan types to find the most suitable option.

- Enroll in a Plan: After selecting a suitable plan, enroll by contacting the insurance provider. This can be done online or by phone. Have your Medicare card and personal details ready for the enrollment process.

- Receive Membership Details: Post-enrollment, you will be issued a new membership card and receive details about the plan’s benefits, coverage, and network.

Ensure to use your new membership card for prescription purchases and keep an eye on any changes in the plan’s coverage or listed medications.

Medicare Part D: How do I get help enrolling?

Exploring Medicare options doesn’t have to be a solo journey. At My Senior Health Plan, our team of skilled senior health advisors is ready to offer their expertise. For comprehensive guidance, reach out to us at (877) 255-6273. We aim to provide clarity and ease in your healthcare decisions, ensuring you’re well-informed every step of the way. Contact us for personalized support in understanding and choosing the right Medicare options for you.

How do I fill Prescriptions at the Pharmacy?

Provide your Medicare card, Prescription Drug Plan Card, and a Photo ID. If you are eligible for both Medicare & Medicaid, you will want to provide proof of your enrollment in Medicaid as well.

How do I Fill my Prescription without my New Plan card?

If you need to go to the pharmacy before your membership card arrives, you can use any of these as proof of membership to the pharmacist of your Medicare Part D plan participation:

- The acknowledgement, confirmation, or welcome letter you got from the plan.

- An enrollment confirmation number you got from the plan, and the plan name and phone number.

- A temporary card you may be able to print from MyMedicare.gov.

If you don’t have any of the items listed above, your pharmacist may be able to get your drug plan information if you provide your Medicare number or the last 4 digits of your Social Security Number.

If your pharmacist can’t obtain your drug plan information, you may have to pay out-of-pocket costs for your prescriptions. If you do, save your receipts and contact your plan to get your money back.

If you have questions about Prescription Drug Plans (PDP) and Medicare Part D Coverage, please contact My Senior Health Plan for more information.

Medicare Part D FAQs:

FAQ #1: Can you explain Medicare Part D?

A: Medicare Part D, an optional program within Medicare, offers prescription drug coverage to its enrollees. This program is administered through private insurance companies approved by Medicare, designed to assist participants in managing the costs of their prescription drugs.

FAQ #2: Is Medicare Part D enrollment dependent on my income?

A: Medicare Part D’s prescription drug coverage isn’t influenced by income levels. Nonetheless, individuals with higher incomes might incur an extra fee, the Income-Related Monthly Adjustment Amount (IRMAA), applicable to both Medicare Part B and Part D. This additional charge is paid on top of the standard Medicare Part D premium by those with higher income brackets.

FAQ #3: Are all Medicare Part D plans the same?

A: Medicare Part D plans are not all uniform. Offered by various private insurers, these plans differ in the medications they cover, cost structures, and the pharmacies within their networks. Each plan comes with a distinct formulary, and a comprehensive list of covered prescription drugs.

FAQ #4: Is it possible to switch Medicare Part D plans once I enroll?

A: You have the option to change your Medicare Part D plan annually during the Annual Enrollment Period, which is from October 15th to December 7th. Additionally, if you qualify for a Special Enrollment Period (SEP) due to specific circumstances, you can also make changes then. It’s crucial to review and assess the details of your current plan each year, including its coverage and cost, to ensure it still effectively fulfills your healthcare requirements.

FAQ #5: Does Medicare Part D cover all drug costs?

A: Medicare Part D plans each have their own specific list of covered prescription drugs, known as a formulary. These formularies are required to include a minimum of two drugs in each drug category and class, but they vary annually. If a particular medication isn’t listed in your plan’s formulary, you might face the full cost unless you successfully request an exception from your plan. This means it’s essential to regularly review your plan’s formulary to understand what medications are covered and to plan for any changes.

FAQ #6: What is the Medicare “Extra Help” program?

A: Extra Help is a program offered by Medicare to aid individuals with limited income and resources in managing their Medicare Part D expenses. To apply for Extra Help, you can visit the Social Security Administration’s website at ssa.gov or make a phone call to 1-800-772-1213. This program is specifically designed to provide financial assistance with Medicare Part D costs for those who qualify based on their financial situation.

FAQ #7: What are Medicare Part D preferred pharmacies?

A: Certain Medicare Part D plans offer a feature called “preferred pharmacies” within their network. By choosing these preferred pharmacies, you can benefit from reduced copays and lower out-of-pocket expenses compared to using other pharmacies within the plan’s network. This feature is designed to offer more cost-effective options for prescription drug purchases under the plan.

FAQ #8: Can Mail-Order Pharmacy Services Be Accessed Through Medicare Part D?

A: Numerous Medicare Part D plans offer the convenience of mail-order services for prescriptions. This feature allows beneficiaries to have their medications delivered straight to their homes, often in three-month supplies. Opting for mail-order can not only save time but may also reduce costs compared to purchasing from traditional retail pharmacies.

FAQ #9: If I move, what happens to my Medicare Part D plan?

A: Medicare Part D plans, provided by private insurers, are specific to geographic regions. If you relocate outside your plan’s coverage area, you’ll need to switch to a new Part D plan in your new location. Inform your existing Part D provider about your move promptly. They will guide you on the necessary steps for a seamless transition to a new plan in your new area.

FAQ #10: What are the steps to file a claim with Medicare Part D?

A: Generally, you won’t have to manually file claims under Medicare Part D as your pharmacy and plan provider handle this automatically. In rare cases where you need reimbursement, contact your Medicare Part D plan for their specific claim form and submission guidelines. Your plan provider’s contact details are available on your membership card.